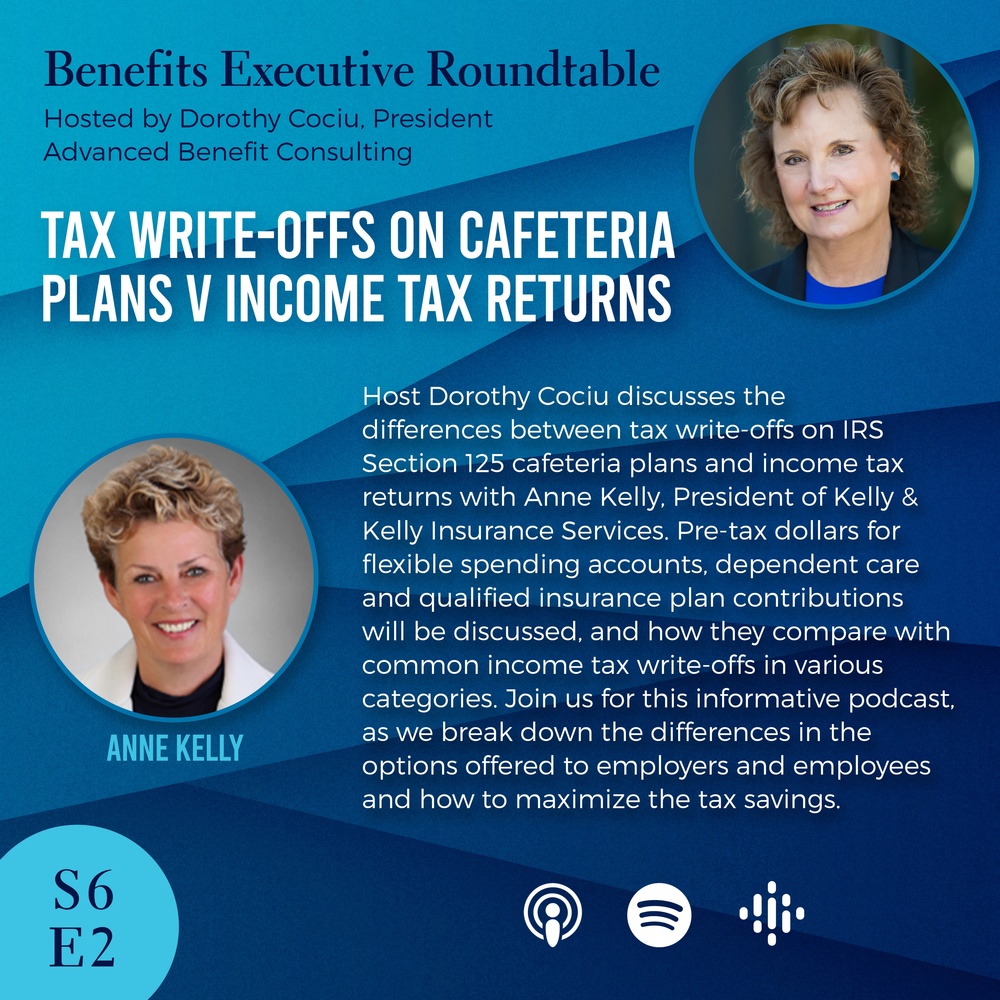

Host Dorothy Cociu discusses the differences between tax write-offs on IRS Section 125 cafeteria plans and income tax returns with Anne Kelly, President of Kelly & Kelly Insurance Services. Pre-tax dollars for flexible spending accounts, dependent care and qualified insurance plan contributions will be discussed, and how they compare with common income tax write-offs in various categories. Join us for this informative podcast, as we break down the differences in the options offered to employers and employees and how to maximize the tax savings.

Watch & Listen to Video Podcast

Listen Now