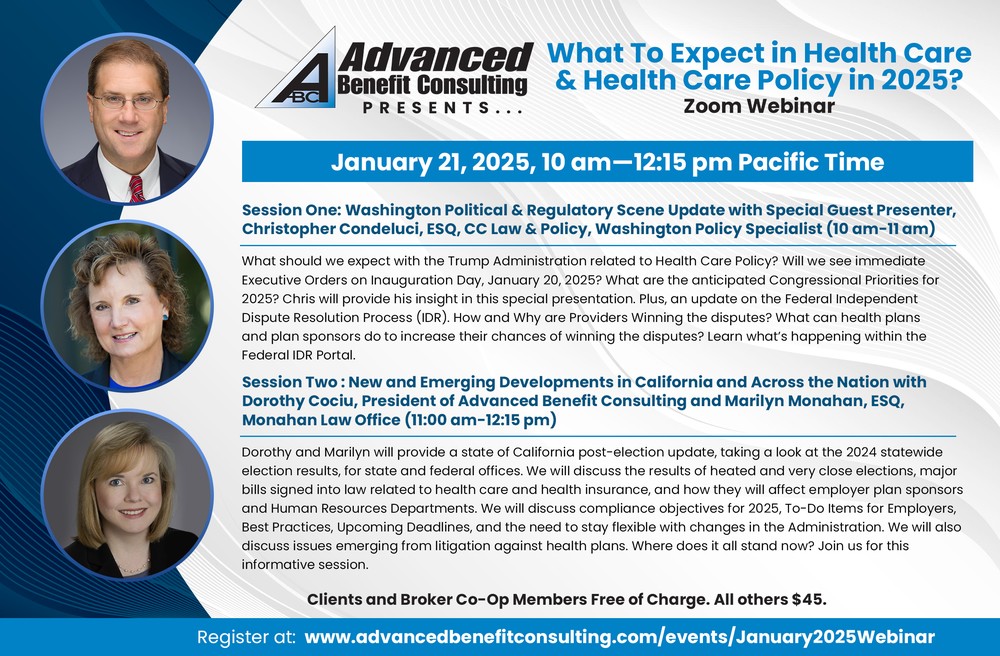

Program Overview

Session One: Course Summary: The unexpected election results in November, 2024 sent shock-waves through Washington and the country, with Trump surprisingly breaking through the “Blue Wall,” winning MI, PA, and WI, and winning all of the swing states of AZ, GA, NC and NC, and winning the popular vote. There is a general feeling among Democrats that they overestimated the importance of abortion and reproductive rights and underestimated the economy, inflation and border security. With republicans winning the Senate and House, they can use the “Reconciliation Process” to pass Republican Policies. Will they end the ACA’s enhanced premium subsidies at the end of 2025? Will there be a rush of Executive Orders signed on day one and in the first month? ICHRAs may also be modified to be more attractive to employers. Transparency, data-sharing, PBM reforms in healthcare, as well as the likelihood of extending the 2017 tax cuts, and what may happen in the new Administration with the ACA, will be discussed. How does all of this impact employer-sponsored coverage and self-funded plans? Will they expand HSAs, Direct Primary Care and Telehealth? Chris will share his thoughts on possible new regulations and other Administrative Actions early in 2025. In addition, he will provide an update on the No Surprises Act’s Independent Dispute Resolution Process and how and why Providers seem to be winning the majority of the disputes. What can plan sponsors and health plans do to control health plan costs and win more of these disputes? This Program has been pre-approved for 1 hour of HRCI General Credit toward aPHR®, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™ recertification through HR Certification Institute® (HRCI®).

Session Two: Course Summary: Dorothy and Marilyn will provide a brief state of California post-election update, taking a look at the 2024 statewide election results, for state and federal offices, and will focus on how these election results will affect employers and human resources departments in 2025. We will discuss major bills signed into law related to health care and health insurance, and how they will affect employer plan sponsors and human resources departments. We will discuss compliance objectives for 2025, to-do items for employers, best practices, upcoming deadlines, and the need to stay flexible due to changes in the administration in Washington. Specifically, we will cover employer and HR priorities for 2025, and new developments human resources professionals should be aware of, including HDHP telehealth provisions which are expiring, new HIPAA rules and multiple requirements pertaining to reproductive health care PHI, reminders on annual RxDC reporting and carrier communications that generally happen between January and March of each year, and what HR needs to do when they receive these communications. In addition, we will discuss briefly the requirements for (and status of) the Corporate Transparency Act (CTA), and issues emerging from litigation against health plans. Where does it all stand now? This Program has been pre-approved for 1.25 hours of HRCI General Credit toward aPHR®, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™ recertification through HR Certification Institute® (HRCI®).

Register Below for this Important and Timely Webinar!

Speaker Bios

Chris Condeluci, Esq, CC Law & Policy

Christopher E. Condeluci is principal and sole shareholder of CC Law & Policy, a legal and policy practice that focuses on the Patient Protection and Affordable Care Act (“ACA”) and its impact on stakeholders ranging from employers and third-party administrators to health IT companies and hospital/health systems. Prior to forming CC Law & Policy, Chris served as Tax and Benefits Counsel to the U.S. Senate Finance Committee. During his time in Congress, Chris participated in the development of portions of the ACA, including the Exchanges, the State insurance market reforms, and all of the taxes enacted under the law. Based on his experience as an employee benefits attorney, Chris possesses a unique level of expertise on matters relating to tax law, ERISA, and the ACA.

Marilyn Monahan, ESQ, Monahan Law Office

Marilyn A. Monahan is the owner of the Monahan Law Office in San Marcos. Marilyn focuses her law practice on advising employers and consultants on compliance with employee benefit and insurance laws, including ACA, ERISA, HIPAA, and COBRA. Her volunteer activities include serving as Secretary of the Employee Benefit Planning Association (EBPA). Marilyn has also served on the Board of Directors of the Professionals in Human Resources Association (PIHRA) (2008-2018). She has represented Advanced Benefit Consulting since its inception in 1995.

Dorothy M. Cociu, RHU, REBC, GBA, RPA, President, Advanced Benefit Consulting

Dorothy Cociu is the President of Advanced Benefit Consulting & Insurance Services, Inc.. She is a leading compliance consultant in the areas of ERISA, HIPAA Privacy & Security, The Affordable Care Act, CAA, Transparency in Coverage and other federal laws and regulations. She is a published author, with a compliance manual (The ABC’s of HIPAA Compliance, published 2000, with updates), and over 90 articles published on the topics above, plus self-funding, cost containment, reference based pricing, and other employee benefits and compliance topics. Her firm specializes in large group employee benefits programs and benefits compliance.