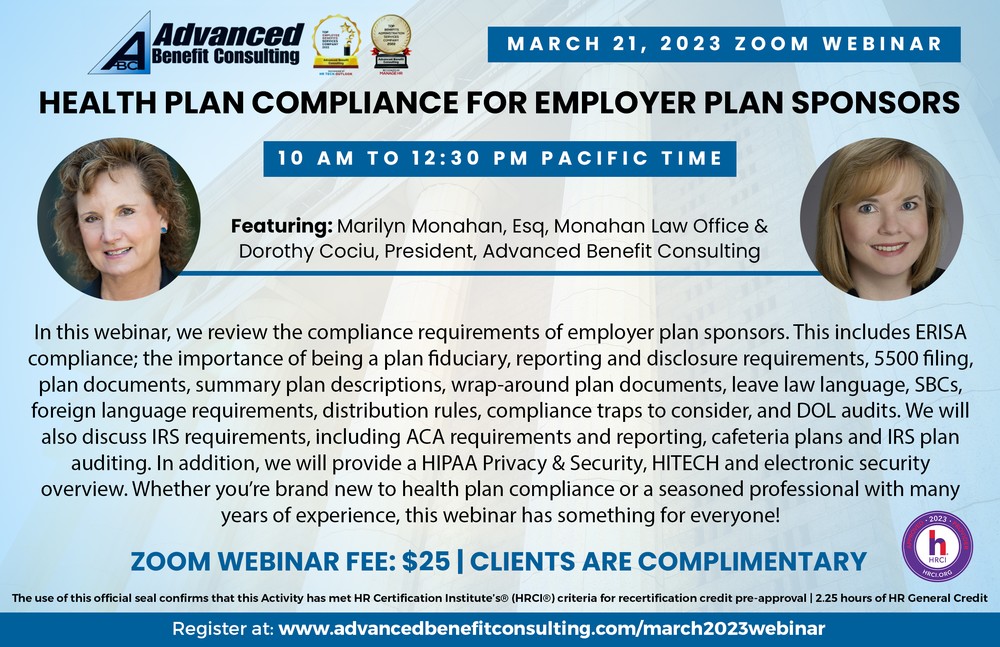

March 21, 2023 Zoom Webinar

Health Plan Compliance for Employer Plan Sponsors

This is a 2 hour & 15 minute program, with additional time allocated for

webinar participant questions.

10-12:15 program, 12:15-12:30 Q&A.

2.25 Hours of HRCI General

Credit Available!

In this webinar, we review the compliance requirements of employer plan sponsors. This includes ERISA compliance; the importance of being a plan fiduciary, reporting and disclosure requirements, 5500 filing, plan documents, summary plan descriptions, wrap-around plan documents, leave law language, SBCs, foreign language requirements, distribution rules, compliance traps to consider, and DOL audits. We will also discuss IRS requirements, including ACA requirements and reporting, cafeteria plans and IRS plan auditing. In addition, we will provide a HIPAA Privacy & Security, HITECH and electronic security overview. Whether you’re brand new to health plan compliance or a seasoned professional with many years of experience, this webinar has something for everyone!

Zoom Webinar Fee: $25 per person

Clients are complimentary

ABC Broker Co-op Members complimentary (subject to verification)

“The use of this official seal confirms that this Activity has met HR Certification Institute’s® (HRCI®) criteria for recertification credit pre-approval.”

Learning Objectives:

• To understand the federal oversight in health plan compliance

• To understand ERISA compliance and when it applies

• To understand the importance of being a plan fiduciary

• To understand reporting & disclosure requirements for health plans, including 5500 filings, Schedule A and Schedule C, who has to file and when, and the Delinquent Filer Voluntary Compliance Program

• To learn how to do a self-audit and prepare for DOL audits

• To understand the requirements for plan documents, SPDs, Wrap-Around Documents

• To understand the contents of an SBC

• To understand foreign language and distribution rules

• To understand the role of the IRS in the Affordable Care Act, employer reporting, and the impact of IRS audits

• To understand the basics of HIPAA compliance, HIPAA Privacy & Security, HITECH and Electronic Security in your organization

Speaker Bios

Marilyn Monahan, ESQ, Monahan Law Office

Marilyn A. Monahan is the owner of the Monahan Law Office in San Marcos. Marilyn focuses her law practice on advising employers and consultants on compliance with employee benefit and insurance laws, including ACA, ERISA, HIPAA, and COBRA. Her volunteer activities include serving as Secretary of the Employee Benefit Planning Association (EBPA). Marilyn has also served on the Board of Directors of the Professionals in Human Resources Association (PIHRA) (2008-2018). She has represented Advanced Benefit Consulting since its inception in 1995.

Dorothy M. Cociu, RHU, REBC, GBA, RPA, President, Advanced Benefit Consulting

Dorothy Cociu is the President of Advanced Benefit Consulting & Insurance Services, Inc.. She is a leading compliance consultant in the areas of ERISA, HIPAA Privacy & Security, The Affordable Care Act, CAA, Transparency in Coverage and other federal laws and regulations. She is a published author, with a compliance manual (The ABC’s of HIPAA Compliance, published 2000, with updates), and over 90 articles published on the topics above, plus self-funding, cost containment, reference based pricing, and other employee benefits and compliance topics. Her firm specializes in large group employee benefits programs and benefits compliance.